The Indian real estate landscape is undergoing a strategic shift. Investors who once focused solely on residential apartments are now turning their attention toward investment in office space and for good reason. Higher rental yields, long-term lease security, and consistent demand from businesses are making commercial offices a powerful wealth-building asset.

In a time when investors seek stability and predictable income, office spaces are emerging as one of the most reliable segments within commercial property investment.

Why Commercial Office Space Is Gaining Investor Confidence

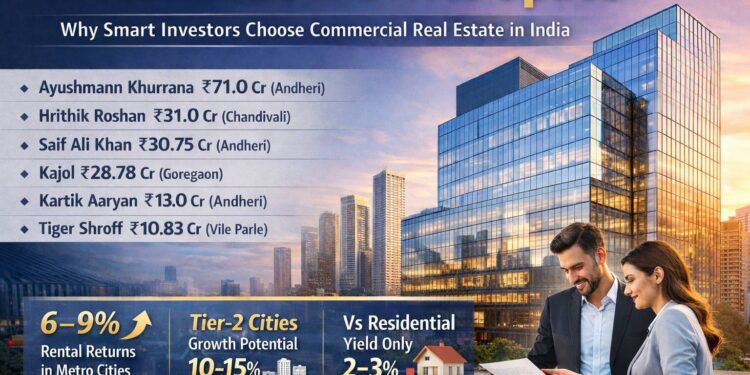

One of the strongest reasons investors prefer office properties is income efficiency. Commercial offices in major metro cities like Mumbai offer 6–9% annual rental returns, while residential properties usually deliver only 2–3%.

This clear yield advantage allows investors to generate steady monthly income while also benefiting from long-term appreciation. For business-minded investors, this combination makes commercial real estate office space a logical and performance-driven choice.

Celebrity Office Investments Signal Market Confidence

The growing appeal of investing in office buildings is further validated by recent celebrity transactions in Mumbai’s key business districts:

- Ayushmann Khurrana – ₹71.0 crore (Andheri)

- Hrithik Roshan – ₹31.0 crore (Chandivali)

- Saif Ali Khan – ₹30.75 crore (Andheri)

- Kajol – ₹28.78 crore (Goregaon)

- Kartik Aaryan – ₹13.0 crore (Andheri)

- Tiger Shroff – ₹10.83 crore (Vile Parle)

These investments highlight how premium office properties are increasingly seen as secure, income-generating assets rather than speculative purchases.

Office Space Investment Benefits That Matter to Business Investors

Office properties typically attract corporate tenants with longer lease commitments, often ranging from 3 to 9 years. This reduces vacancy risk and ensures income continuity.

Additionally, professional tenants usually manage interiors and maintenance, improving office property investment returns and lowering ownership hassles. Rent escalation clauses further protect investors from inflation over time.

Key Office Space Investment Benefits Investors Can’t Ignore

Long-Term Lease Security

Office spaces are usually leased to established businesses, MNCs, or startups for 3–9 years, ensuring stable income and lower vacancy risk compared to residential rentals.

Professional Tenants and Lower Maintenance Hassles

Commercial tenants handle interiors, utilities, and often maintenance, reducing operational stress for owners. This improves net office property investment returns over time.

Inflation Protection

Rental escalation clauses in commercial leases help office investors stay protected against inflation — a benefit residential landlords rarely enjoy.

Expected Commercial Property Price Growth by 2026

India’s Tier-2 cities are emerging as strong alternatives to crowded metros, offering affordability and faster appreciation.

| City | Growth Drivers | Estimated Price Growth |

|---|---|---|

| Jaipur | Tourism, industrial corridors, IT hubs | 10–12% |

| Indore | Clean city status, Super Corridor, Metro | 12–15% |

| Coimbatore | Manufacturing base, retirement living | 10–12% |

| Nagpur | Logistics hub, metro connectivity | 8–10% |

| Ayodhya | Religious tourism, hotels & homestays | 15–20% |

| Varanasi | Religious tourism, hospitality growth | 15–18% |

These numbers show why investors are now diversifying beyond Tier-1 markets to maximize capital growth.

Tier-1 vs Tier-2 Cities: Choosing the Right Growth Market

While Tier-1 cities provide stability and established demand, Tier-2 cities are becoming hotspots for faster appreciation due to infrastructure development and economic expansion.

Tier-2 markets like Jaipur, Indore, Coimbatore, and Nagpur offer affordable entry points and capital growth potential of 10–15%, compared to 5–7% in saturated Tier-1 cities. For investors with a long-term vision, this shift opens new opportunities for portfolio diversification.

Tier-1 vs Tier-2 Commercial Property: Where Should You Invest?

Choosing between metros and emerging cities depends on risk appetite and budget.

| Parameter | Tier-1 Cities | Tier-2 Cities |

|---|---|---|

| Property Prices | Very high | Affordable |

| Capital Appreciation | Stable 5–7% | Faster 10–15% |

| Infrastructure | Developed but congested | Rapidly improving |

| Competition | Very high | Moderate |

While Tier-1 cities offer stability, Tier-2 cities provide growth momentum — making a balanced portfolio strategy ideal.

Future Outlook for Office Space Investment in India

With the rise of startups, global business expansion, and hybrid work models, demand for flexible and strategically located office spaces continues to grow. Companies are moving beyond crowded central districts toward emerging commercial corridors, creating fresh demand across multiple cities.

This evolving business environment positions commercial property investment as a future-ready strategy for investors seeking stability, income, and sustainable growth.

FAQs: Office Space Investment Explained

Is office space a good investment in 2026 and beyond?

Yes. With higher rental yields, long-term leases, and rising business demand, office assets are considered more resilient than residential properties.

How much return can I expect from office property investment?

Depending on location and tenant quality, investors can expect 6–9% rental returns, along with capital appreciation.

Are Tier-2 cities safe for commercial real estate investment?

Many Tier-2 cities are backed by infrastructure upgrades, metro connectivity, and industry growth, making them ideal for long-term investors.

Who should invest in office buildings?

Investors seeking stable income, lower vacancy risk, and professional tenant management benefit most from investing in office buildings.

Final Thoughts

The Indian real estate story is no longer limited to homes and apartments. Investment in office space is redefining wealth creation by offering better returns, reduced volatility, and long-term financial security.

As celebrity investments, rising rental yields, and city-level growth data clearly indicate, office properties are not just assets — they are income engines built for the future.